In an era marked by escalating global trade tensions, shifting economic dynamics, and unprecedented market turbulence, investors are grappling with heightened uncertainty. Even blue-chip stocks like NVIDIA and Tesla have experienced sharp price swings, underscoring the fragility of traditional equity exposures. Meanwhile, declining interest rates have eroded the appeal of cash and money market funds, signaling the end of an era of low-risk, high-liquidity returns. Against this backdrop, the critical challenge for investors is twofold: how to safeguard capital while generating sustainable income in a volatile market.

The Dual Pressures of Lower Rates and Higher Volatility

According to Noah Holdings’ Chief Investment Officer (CIO) Office, two trends are reshaping the investment landscape. First, U.S. dollar interest rates have retreated from recent peaks, diminishing the yield on cash-equivalent instruments. Projections suggest further rate cuts, exacerbating the challenge for income-focused investors. Second, U.S. equity volatility has surged, as evidenced by the CBOE Volatility Index (VIX). For holders of dollar-denominated assets, this environment necessitates a reevaluation of portfolio construction—emphasizing stability and risk-adjusted returns over aggressive growth.

Enter Fixed Coupon Notes (FCNs), a structured product that has gained prominence as a solution for core portfolio allocations. FCNs combine fixed-income attributes with equity-linked upside potential, offering a balanced approach to capital preservation and income generation. Their strategic relevance is underscored by institutional investors like Warren Buffett, who has utilized similar structures to invest in Coca-Cola, and Duan Yongping, who deployed FCNs in holdings such as NVIDIA, Apple, and Tencent.

FCNs: A Pyramid Approach to Portfolio Resilience

The 2025 First-Half CIO Report by ARK Wealth Management advocates a pyramid-shaped asset allocation framework, comprising three layers:

Safety Cushion: High-quality, liquid assets to mitigate extreme downside risks.

Core Stable Holdings: Foundational allocations designed to anchor the portfolio, with FCNs emerging as a prime candidate for this layer.

Growth-Oriented Exposures: Tactical positions in equities or alternative assets to capture upside.

FCNs align seamlessly with the core stable holdings layer, providing three layers of protection:

Consistent Income: FCNs deliver fixed coupon payments regardless of market fluctuations, offering a reliable cash flow stream.

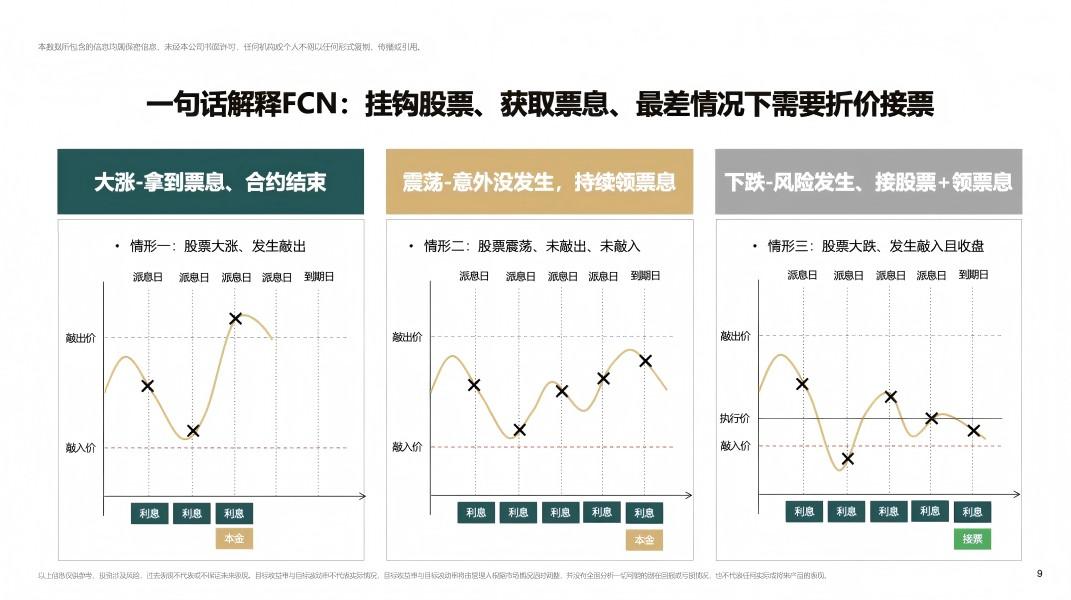

Automatic Profit Lock-In: If the underlying asset hits a predefined “knock-out” level, the FCN redeems early, returning principal plus accrued coupons—a feature that shields investors from subsequent market declines.

Downside Mitigation: Even if the asset price falls below the “strike price,” investors retain the principal (or receive physical delivery of shares) and continue earning coupons, softening the impact of losses.

How FCNs Work: A Case Study with NVIDIA

To illustrate, consider an FCN linked to NVIDIA, structured with a 120strikeprice,a14150.

Upside Scenario: If NVIDIA’s price reaches $150, the FCN redeems early, securing the principal and coupons.

Stable/Moderate Decline Scenario: If the price hovers between 120and150, the investor earns coupons without triggering a knock-out, maintaining flexibility.

Downside Scenario: If the price drops below $120 (but remains above the knock-in barrier), the investor receives coupons and the principal at maturity, offsetting some of the equity loss.

This structure enables investors to participate in equity upside while limiting downside risk—a compelling proposition in volatile markets.

Customization: Tailoring FCNs to Investor Needs

FCNs’ adaptability makes them suitable for diverse investor profiles:

Conservative Investors: Prioritize high-quality, low-volatility underlyings (e.g., blue-chip stocks) with defensive pricing structures to enhance capital stability.

Growth-Oriented Investors: Opt for FCNs linked to tech giants or emerging-market equities, balancing higher yields with controlled risk.

Thematic Investors: Target specific sectors (e.g., AI, clean energy) via FCNs, gaining exposure to trending assets while mitigating volatility.

Strategic Timing: Why Now?

ARK Wealth Management identifies three reasons to consider FCNs today:

Yield Advantage: FCNs offer annualized returns exceeding those of money market funds, appealing to income-starved investors.

Liquidity and Flexibility: With maturities typically ranging from 3 to 12 months, FCNs enable tactical reallocation in response to changing market conditions.

Volatility Harnessing: In a high-volatility regime, FCNs’ defensive features (e.g., knock-outs, coupons) provide a buffer against equity drawdowns.

Conclusion: FCNs as a Core Portfolio Anchor

In a market characterized by uncertainty, FCNs represent a versatile tool for investors seeking to balance risk and reward. By combining fixed-income stability with equity-linked upside, they offer a compelling solution for core portfolio allocations. As ARK Wealth Management emphasizes, now is an opportune time to explore customized FCN strategies, leveraging their structural advantages to navigate a shifting economic landscape. Investors are encouraged to consult financial advisors to design FCN portfolios tailored to their long-term objectives and risk tolerance.

In summary, FCNs are not just a product—they are a strategic imperative for resilient portfolio construction in the 2020s and beyond.